It’s been ages since I’ve written a pricing blog. It’s also been a decent chunk of time since we’ve seen a new entrant to the advised platform market. A glorious piece of serendipity then to see that Hubwise has (re)launched[1] its advised proposition and given me reason to get the Casio out.

Those who monitor this part of the market closely will know that there has in fact been a decent bit of activity on the pricing front this year. Ascentric and James Hay have launched new shapes, Nucleus and Transact made some shavings round the edges and Alliance Trust Savings and Elevate made increases to their charges.

Pricing activity then has been a bit of a mixed bag. Some new shapes, some marginal decreases, some increases. This is a market that has been converging to a mean, as opposed to racing to the bottom.

With that in mind, let’s look at a summary of what Hubwise are bringing to market:

- Main platform charge is an ongoing custody fee of 0.2% capped at £40 per month. (For those who like primary school arithmetic carried out for them, this works out at a charging cap once you hit £240,000)

- Before you get carried away, it’s important to note that this applies on a per account type basis. i.e. If you have a mixed wrapper portfolio with £100k in an ISA, £200k in a GIA and £700k in a pension then you’ll get a charge of 0.2% taken off the ISA and GIA and £480 taken off the pension.

- The pension wrappers cost an additional £114 (£95+VAT) and Offshore Bond is £250

- Fund switching is bundled in. No charges here.

- ETI trading is low – £2 for individual trades and £1 as part of regular subscriptions or bulk buying.

So, if those are the headlines, how do they shape up against the rest of the market? Remember, the pricing tables that you see here are a subset of the full peer group and AUA points that paid subscribers get. We use a complex fairness algorithm (haha!) to decide who to show in blogs. If you want more details, get in touch.

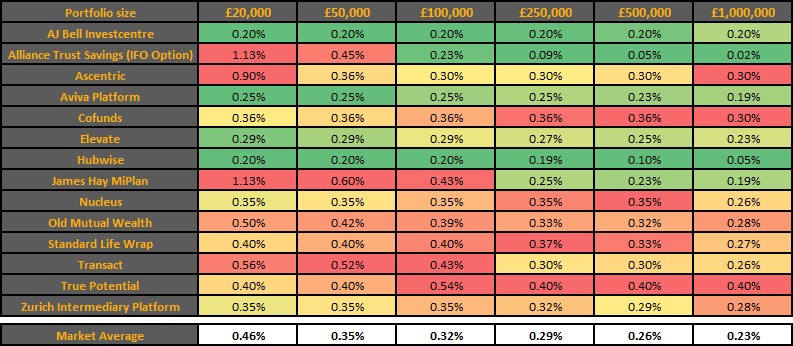

Looking at ISA/GIA first. Here we assume platform custody charges only. Buy and hold in funds, no switching.

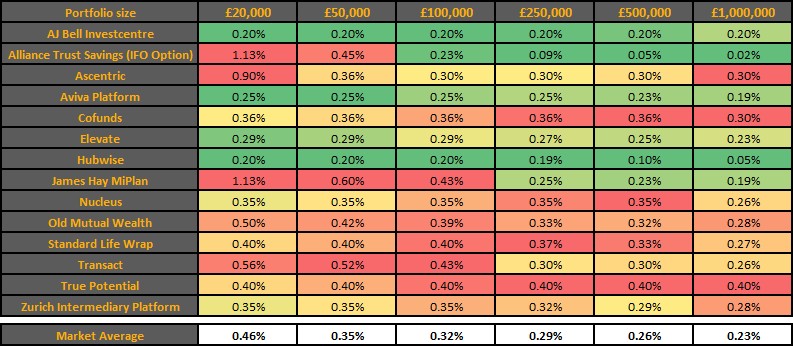

Same assumptions as before but in a pension this time around.

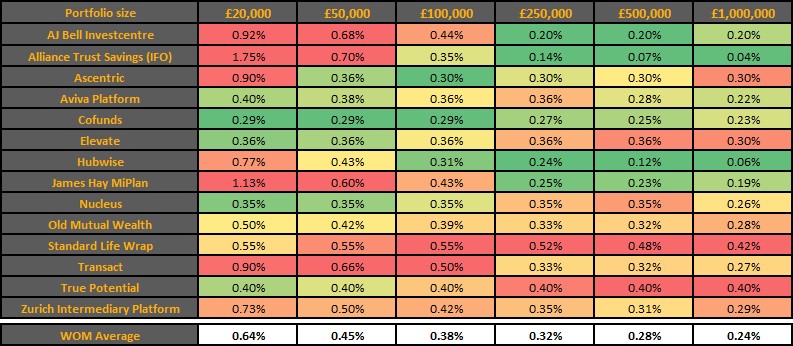

And here we look at a representative mixed-wrapper portfolio. Proportionate 50/25/25% investment in Pension/ISA/GIA. Quarterly rebalancing of a 10-fund model portfolio.

So, headline conclusions:

- The pension fee bites at the lower end, albeit this is in line with many peers who charge an explicit pension admin fee (The likes of AJ Bell, Transact, Zurich etc)

- We place the market average platform holding at a shade over £100k. Our tables show that Hubwise are keenly priced here, under the market average for both individual wrappers and mixed portfolios

- As you move up the food chain, this difference becomes starker, with Hubwise a double-digit number of basis points below the market average.

So, it’s pretty much good news all round on the pricing front. It’s a low-cost offering at the medium to chunky AUA points and will remove price as a potential barrier for use, something that you feel is crucial for a new(ish) entrant to the market.

Pricing isn’t the be all and end all, as you know, it’s only one aspect of provider assessment and client suitability. Something inexpensive and unsuitable is still unsuitable and all that. For a rundown of what Hubwise offers you can access a tonne of information in our free online directory.

In the coming weeks the indefatigable Terry Huddart, our head of proposition, will be going medieval on the detail of where Hubwise compares to its peers, keep an eye out for that. We all need something to look forward to.

[1] Hubwise launched a few years ago now but is now making a renewed push for growth. The platform currently has £500m in AUA