The last few months have been an exciting time for Leith’s leading * platform and investment consultancy. We’ve never been busier, and increasingly we are convinced that most of our core markets are about to be disrupted. The recent FCA Asset Management Study is without doubt my favourite read of the year, a real page turner, and I for one can’t wait for the next chapter to be revealed next year. Over in the D2C platform world, there has been much speculation recently about how this market is also about to be disrupted. At lang cat HQ we completely agree, but initially we think this disruption will come from the banks as opposed to the fintech world, and the great news is this disruption is now starting in front of our very eyes.

Last week Barclays quietly rolled out their direct investing service to their entire current account customer base. And this week they started telling people about it. Anyone who has a Barclays current account can access the service now, with a roll-out to non-Barclays – customers coming next year. This follows on from the recent (much quieter) launch of Santander’s Investment Hub all of which means that, suddenly, over 25% of the population (based on current account market share) are now able to access an investment platform through their bank. This feels disruptive to us, and is certainly a new channel that advisers, advised platforms and D2C providers have not had to contend with over recent years. The banks are back…….

Barclays very kindly showed me the new service last week (full disclosure, we have worked with them on some pricing analysis) and first impressions are good. The UI is clean & crisp, and is consistent with the current account portal where you will find the service. Considering the platform is built on FNZ technology this is no mean feat, and Barclays are one of the first providers to use the FNZ One platform which gives firms much more ability to bespoke the UI. Unlike previous FNZ deployments itâs impossible to tell who the tech supplier is, and the system looks great as a result.

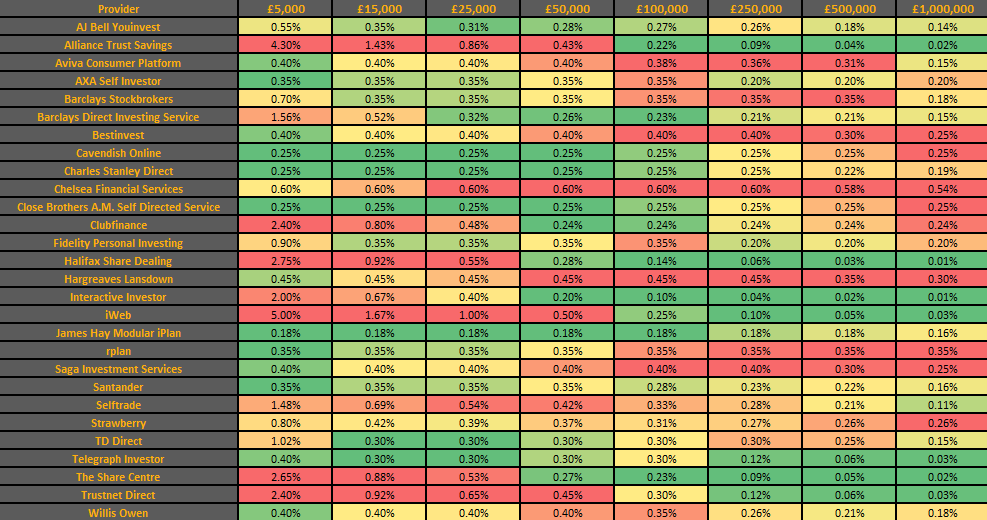

Pricing wise, Barclays have been pretty aggressive. The core fee of 0.2% puts them amongst the cheapest platforms going, although with fees for some (but not all) transactions you could easily end up paying more than the headline rate. The good news is that the system very clearly discloses these fees, both at the point of transaction and at valuations, and there is also a pricing cap. With an ever increasing focus on costs and transparency this is a good move, and one we wish more platforms (especially in the advised space) would adopt. Whilst price isn’t everything, for certain customers this is an extremely cost effective option. Very early days, but this feels like a very significant launch.

Fans of our work (Hello Mum) will know that we have been speculating about the banks returning to the platform world for a while now, posing our considered question of – what if the banks don’t screw it up? Again. – They have a huge advantage with their already acquired customers, something all the start-up D2C providers would kill for , but their track record isn’t great. A google search on the right (or wrong, depending on your point of view) words will bring up details of several enforcement notices for unsuitable advice and outcomes. As it stands, both Barclays and Santander are currently offering execution only services, but we expect this to change during next year. With financial advisers increasingly serving the HNW the opportunity, and arguably the need, for someone to fill this space with simple, transparent, low cost advice services has never been greater. Robo technology should, in theory, remove a lot of the causes of previous failures by delivering a consistent and repeatable advice process. If this is consistently delivering suitable advice then maybe, just maybe, the banks won’t screw up again. It’s a big opportunity for them, and the prize is theirs to lose.

* = probably